It has great cost advantages and was once a core driving force for Tesla to launch the 4680 large cylindrical battery.

In September 2020, when Tesla first released the 4680 battery, it pointed out that in the future, based on comprehensive innovations in materials, battery cell design, process optimization, manufacturing efficiency and pack design, large cylindrical batteries are expected to bring a 56% cost reduction.

The application of dry electrode technology, the efficient production efficiency of cylindrical batteries, the cost reduction potential brought by large-scale mass production due to standardized sizes, and the all-round performance improvement brought by full-tab technology have made the 46 series large cylindrical batteries widely popular around the world and become the top-tier once they were launched.

However, four years later, the large cylindrical battery is still stuck on the mass production line: not only has it failed to achieve the expected cost reduction target, it is even more difficult and more costly than the current mainstream square battery manufacturing technology.

In May this year, Tesla made a harsh statement to the 4680 battery department: If the cost reduction target cannot be achieved by the end of the year, Tesla may abandon the 4680 project.

It should be pointed out that the cost reduction target at this time is not the 56% cost reduction proposed in 2020, but to be cheaper than similar batteries purchased from suppliers such as Panasonic and LG Energy Solution. Obviously, Tesla has also compromised on the cost reduction target.

01

From "the industry's top stream" to "castles in the air"

Since Tesla released the 4680 battery in 2020, especially with the emergence of innovative technologies such as tab-free (full tab) and dry electrodes, large cylindrical batteries have gradually become a technical route that battery companies are competing to develop, and have become the industry's recognized "top outlet" from 2021 to 2023. Almost every year from 2021 to 2023 is defined as the first year of mass production of large cylindrical batteries.

However, the 46 series large cylindrical battery adopts an innovative structural design, adding processes such as full-ear molding, flattening, laser welding of full-ear and collector plate or shell, opening formation, and laser welding of cover plate . The new design structure brings huge challenges in process, manufacturing and consistency. So far, the yield rate of large cylindrical battery production line has always been a hurdle that many companies need to overcome.

For example, the 46 series cylindrical battery adopts a tab-free design, and the process steps such as battery cutting and laser welding vary greatly. The process is highly complex, and higher requirements are placed on the accuracy and efficiency of the equipment.

At the manufacturing level, there are still uncertainties in large cylindrical batteries, for example, whether the tab processing method is full tab, die-cut tab or beveled tab. The processing technology includes flattening and pressing processes. The welding of collector plate and pole, collector plate and shell/bottom cover is also a more difficult problem.

In fact, as Tesla, which brought the 46 series large cylindrical battery to the industry, has been repeatedly honing in key technology research and development and engineering optimization in the past few years. According to media reports, as of June this year, in nearly four years, Tesla's super factory in Austin, Texas, has only produced 50 million 4680 large cylindrical batteries. Among them, about 40 million 4680 batteries were produced in the past year. Tesla has also spent a long time on key technology research and development, process optimization, and production line yield improvement.

It is worth noting that at this stage, due to the difficulty in improving processes, yields and performance, looking at global battery companies, the output of each company is still relatively limited, and large cylindrical batteries have not demonstrated competitive advantages in cost and performance.

Not only that, the soaring material costs from 21700 to 46 series cylindrical batteries also make it more difficult to reduce costs for 46 series cylindrical batteries.

Taking the steel shell and bottom cover materials used in large cylindrical batteries as an example, the current nickel-plated steel material has relative advantages in conductivity, internal resistance, and weldability, and can relatively meet the requirements in terms of corrosion resistance, but this material is basically imported from abroad. "Compared with traditional 21700 cylindrical batteries, the cost of nickel-plated steel shells used in 4680 cylindrical batteries has increased by 8 to 10 times." Xu Tao, general manager of Guangzhou Dongshi Chuangzhan Energy Technology Co., Ltd., told Battery China.

Initially, large cylindrical batteries were seen as a cost-cutting tool for their extreme efficiency, safety, and manufacturing, and were favored by a number of automakers including Tesla, BMW, GM, Porsche, and NIO. However, today, due to the difficulty in breaking through bottlenecks in process, manufacturing, and yield, as well as rising material costs, most automakers in the domestic market are no longer so enthusiastic about cylindrical batteries.

02

How to break the deadlock?

"It has been four years since the launch of the large cylindrical battery in 2020. All companies have invested a lot of R&D funds and manpower, but there are still bottlenecks in the 46 series battery (manufacturing) process. The cost of mass-produced 46 cylindrical battery cells is still relatively high." Xu Tao believes that this is mainly because the industry has focused on the application of the 46 series cylindrical battery only on the vehicle from the beginning , and is oriented towards vehicle installation. "The vehicle has very high requirements for battery quality, and the development and verification cycle is relatively long. This has led to a small scale of large cylindrical production in the early stage, and many problems have been exposed relatively slowly. It takes a long time to crack the process and yield."

The lack of large-scale mass production means that all problems of large cylindrical batteries cannot be fully exposed in a short period of time, and many process problems continue to appear in small and medium-scale production lines. Battery companies and car companies have to verify and solve them repeatedly.

Xu Tao believes that in order to achieve the maturity of large cylindrical battery technology and processes, as well as the rapid improvement of yield, the entire industry needs to have sufficient scale and volume for large cylindrical battery mass production, expose all potential problems as soon as possible, and then, with the collaboration of the industrial chain, break through related technology, processes and manufacturing difficulties in a relatively fast period of time, and truly achieve rapid cost reduction and performance improvement of large cylindrical batteries.

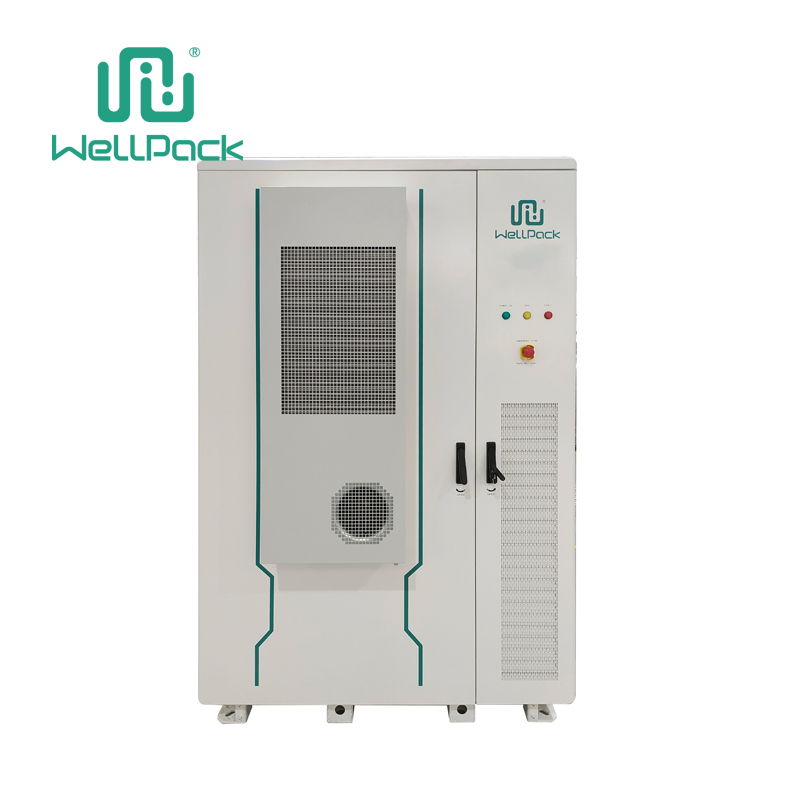

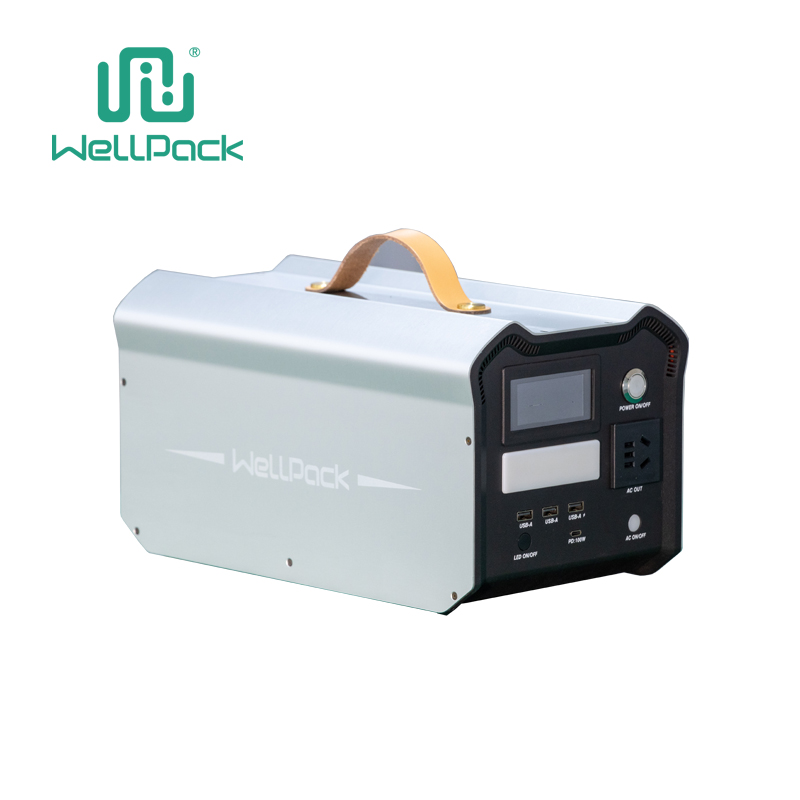

Compared with the high quality requirements of large cylindrical batteries and the huge investment in production lines for complete vehicles, Xu Tao believes that " the development of large cylindrical batteries does not have to be aimed at vehicle installation. There is also a lot of room for scenarios other than vehicle installation, such as long-term energy storage . By leveraging the advantages of large cylindrical batteries in fields that are different from vehicle installation quality requirements, such as high safety, high capacity, flexible grouping, and recycling, we will take the lead in realizing large-scale mass production of 46 series cylindrical batteries. In this process, the problems of large cylindrical batteries will be fully exposed, and solutions will be gradually found and fed back to the quality of the complete vehicle. I believe this will be of great help to the maturity of large cylindrical battery technology and cost optimization."

According to Battery China, battery companies including EVE Energy, Penghui Energy, Haichen Energy Storage, Sino-Belgian New Energy, Aerospace Lithium Battery, and Lihua Power Supply have explored or launched large cylindrical lithium iron phosphate batteries suitable for the energy storage market.

Recently, media reported that Tesla has mastered the dry electrode process and is expected to mass produce and install 4680 batteries that fully use dry electrodes before the end of the year. The reduction in equipment and production materials brought about by dry electrodes is expected to drive down the cost of 46 series large cylindrical batteries.

In terms of material cost reduction, Xu Tao said that currently large cylindrical battery steel shell materials are mainly imported, and there is almost no room for cost optimization. In the future, as related materials are gradually localized, costs are expected to drop by about 30%-40%. It is reported that since 1999, Dongshi Chuangzhan has been cooperating with Japan's Nippon Steel Corporation to develop, produce, process and distribute "special materials for battery steel shells". In the field of cylindrical battery steel shell materials, the company has cooperated deeply with many domestic leading battery companies for many years and has been leading the development of the battery steel shell materials industry. At present, the company is accelerating the construction and continuously improving the research and development and cost optimization solutions for high-end materials for cylindrical batteries.

It can be foreseen that in the future, as more fields begin large-scale mass production and companies in the battery industry chain work together to continuously break through related process and yield pain points, large-scale mass production and installation of large cylindrical batteries will soon come.

Huatai Securities Research Report predicts that by 2027, the global installed capacity of large cylindrical batteries is expected to reach 429GWh, with a corresponding market size of 214.48 billion yuan, and a compound annual growth rate of 110.7% from 2023 to 2027. As large cylindrical batteries are used in energy storage and other power markets, large cylindrical batteries with ultimate performance, ultimate safety, and ultimate production efficiency can truly win more market share at the ultimate cost.